Enter your income from. The average fee for a professional to prepare and submit a Form 1040 and state return with no.

Can You Deduct Tax Preparation Fees

The undersigned certify that as of June 18 2021 the internet website of the California Department of Tax and Fee Administration is designed developed and maintained to be in.

. The California Department of Tax and Fee Administration is responsible for the administration of over 30 different taxes and fees. Personal Income Tax Booklet 2020 Page 93 2020 California Tax Rate Schedules To e-file and eliminate the math go to ftbcagov. 2022 Tax Preparation Fee Schedule Estimate only Effective January 1 2022.

Read this article to find out more about tax planning insights from 2020. Chris and Pat Smith are. Personal casualty or theft losses.

Thus reducing the tax preparation. The average tax preparation fees in the Southeastern United States were only 137 in 2015 while people who live in the Middle Atlantic region paid more than 250 for their income tax. Certain mortgage interest or points above the limits on a federal return.

Pacific Alaska California Hawaii Oregon Washington 329. Easily calculate your own estimate using this Tax Preparation Fee Calculator. To figure your tax online go to.

Form 1040X Amended Tax Return Originally Prepared by Taxlana Inc 20000. Only the self-employed can claim a deduction for tax preparation fees in tax years 2018 through 2025 if Congress does not renew legislation from the TCJA. Tuition and fees deduction.

Easy Tax Preparation Management. Please note that for the 2021 tax filing season the minimum cost of tax return preparation for Form 1040 starts. Tax and Fee Rates.

CPA Professional Review. Ad Ideal For Busy Families and Budgets. Ad Prevent Tax Liens From Being Imposed On You.

The Tax Cuts and Jobs Act TCJA has modified or suspended most of the itemized deductions you once may have claimed as tax prep fees are no longer deductible. The National Society of Accountants Reports on Average Tax Return Preparation Fees states. Are Investment Fees Deductible In California 2020.

In this report weve broken down national and state averages for both individual and business tax returns so you can see. The type of return you file affects the price youll pay for preparation. Line 2 of the Standard Deduction Worksheet for Dependents in the instructions for federal Form 1040 or 1040-SR.

Schedule A Itemized. For instance you can expect to pay more than average on the Pacific Coast and less in the good ol South. Type of return.

Average Tax Preparation Fees. Maximize Your Tax Refund. Form 1040NR US.

Individual Nonresident Income Tax Return. Student loan interest deduction. The fees for hiring a tax professional differ across the country.

Ad Find Recommended California Tax Accountants Fast Free on Bark. This means that if. The average fee charged to prepare an itemized Form 1040 with Schedule A and a state tax return is 273 and the cost for a Form 1040 without itemized deductions and a.

According to a National Society of Accountants survey in 2020 on average you would have paid 323 if you itemized your deductions on your. According to the National Society of Accountants the average fee in 2020 for. To find the correct tax or.

Enter the quantity of forms that you need to file and the total amount will be calulated at the bottom.

:max_bytes(150000):strip_icc()/hrblock_logo1-c3a5cbb43e1245aabb0e7d9b5df074ae.jpg)

The 5 Best Tax Preparation Services Of 2022

We Make You A Fake Tax Return Document For 2017 Or Earlier Year Great Proof Of Annual Income For Application Purp Tax Return Income Tax Return Irs Tax Forms

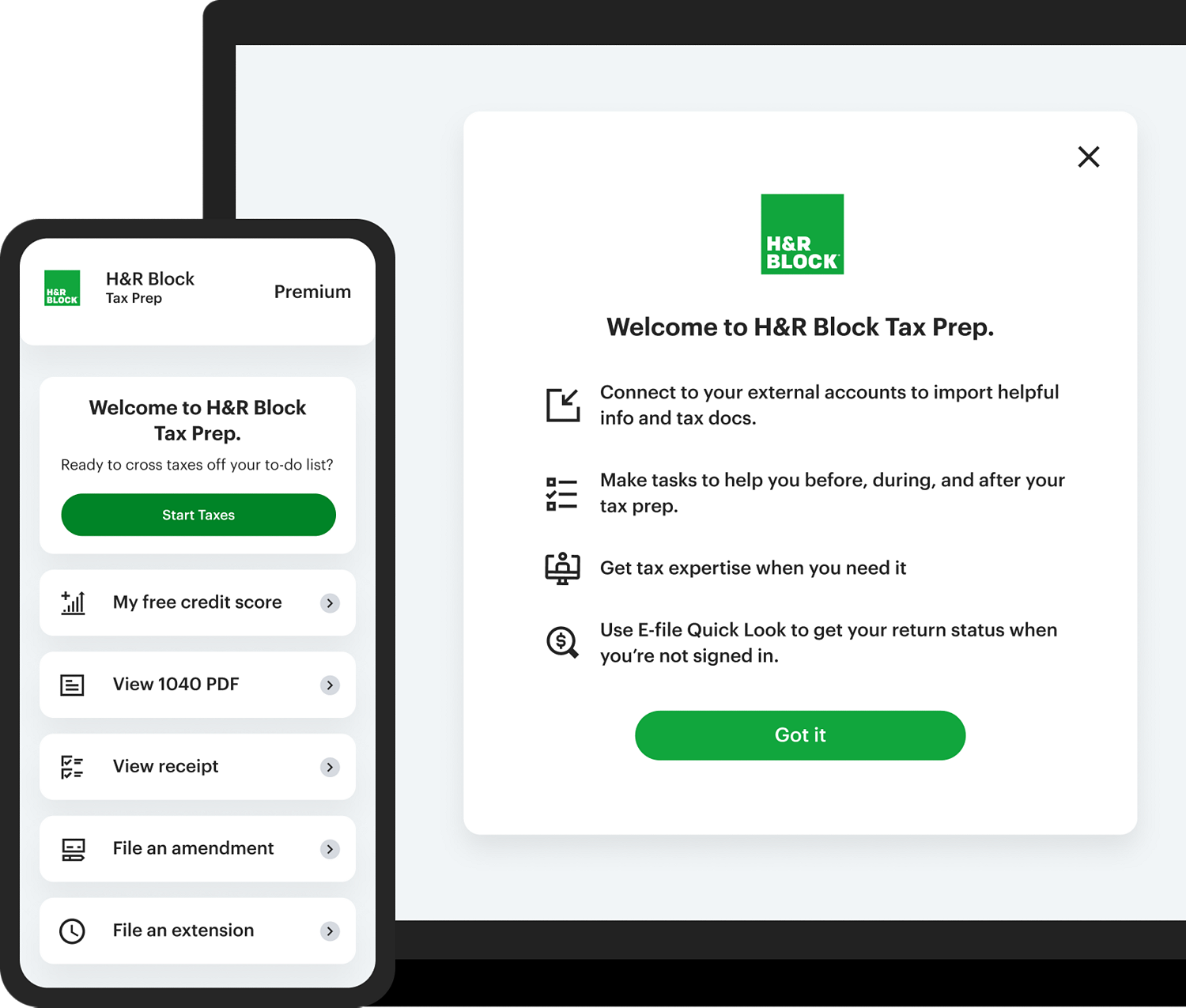

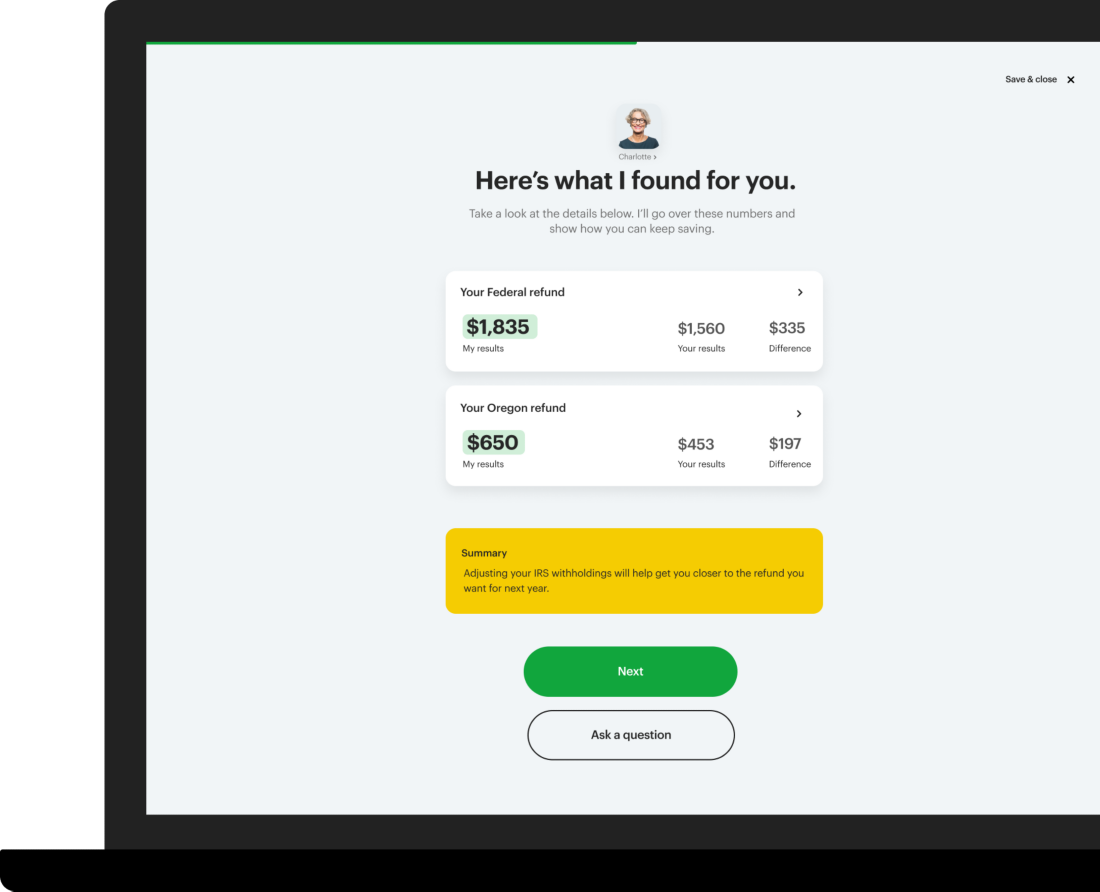

Premium Online Tax Filing And E File Tax Prep H R Block

Individual Income Tax Virtual Individual Tax Training Tax Preparation Services Income Tax Return Income Tax

Californiataxtable Income Tax Brackets Tax Brackets Tax Prep

Tax Services Near Me Tax Services Small Business Tax Tax Accountant

Emily S Virtual Rocket Donald Trump Supreme Court Won T Stop Grand Jury Irs Tax Forms Tax Forms Income Tax Return

Volunteer Income Tax Assistance Vita 2022 California State University Long Beach

Can You File Your Taxes Online For Free In California Oc Free Tax Prep A United For Financial Security Program

Tax Filing Deadline 2020 When Are My State Taxes Due Tax Refund Income Tax Deadline Filing Taxes

Virtual Remote Tax Preparation Services H R Block

Deluxe Tax Preparation Software H R Block

Freetaxusa Review Pros Cons And Who Should Use It

Can You Deduct Your Tax Preparation Fees Cpa News

Free And Discounted Tax Preparation For Military Military Com

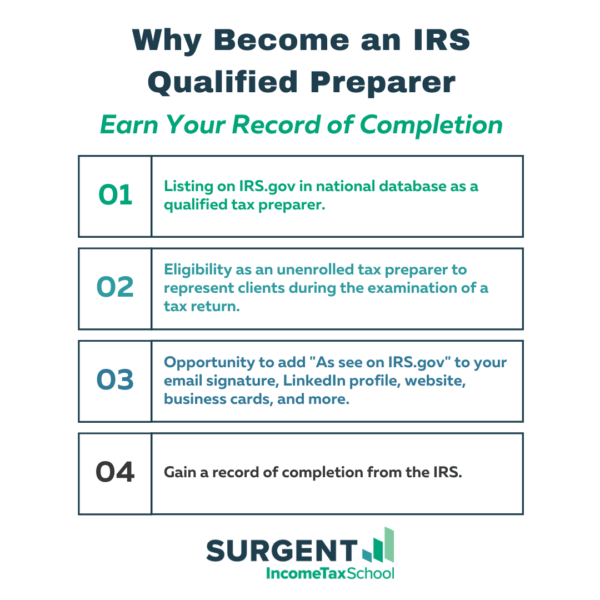

How To Become A Tax Preparer In 4 Easy Steps

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Get Credit For Ira Contributions On 2020 Tax Returns Saving For Retirement Contribution Ira